Welcome to the Global Watch Weekly

Report

In the lead up to the London Olympics for 2012 we are focusing on the true history of the City of

London. Last week we observed the magical and esoteric history of London, focusing on the

magic of Dr Dee and Simon Forman, the rise of the Kabbalah, the occult designs of Wren and

Hawksmoor, the impact of figures such as Spring-Heeled Jack and the Highgate Vampyre, and

the rise of occult organizations from the Invisible College to the Golden Dawn.

However this week our attention turns to the history behind the wealth of London. During the

2008 global financial crisis, it was London and New York who were singled out as the main

culprits in bringing down the global banking system. This Anglo American financial hub is seen

by many today to be the control center of the new world order, and one which is

controlling the

destiny of the world financial systems.

In this weeks edition of the Global Watch Edition we take a look at the “City of London”, one of

the most financially powerful, if not the most financially powerful square mile in the world. This

historical and intellectual insight will provide you a firm foundation for understanding why London

is

such an important location in the global power politics of the global

elite. The City’ – or, ‘The Square Mile’ – refers to the City

of London Corporation. Together with Wall Street,

The City forms the hub of the plutocratic system that controls most

of the world, and is presently engulfing the few remaining states that it does not control, through the time-proven tactics of

plutocracy: revolution ostensibly in the name of ‘the people’.

Because The City is situated in England, and because it is often confused with the ancient capital, London, there has been a lot of obfuscation as to the character of the plutocratic system that is

partially based in The City.

Hence, there has been a great deal stated, even by the well-informed, in regard to the British Empire and even the British Crown, being intrinsically a part of this international oligarchy. This is to

misunderstand the nature of international capital, which owes no steadfast loyalty to any system of government, head of state, religion, ethos, nation, ethnicity or culture. Any such allegiance is

conditional.

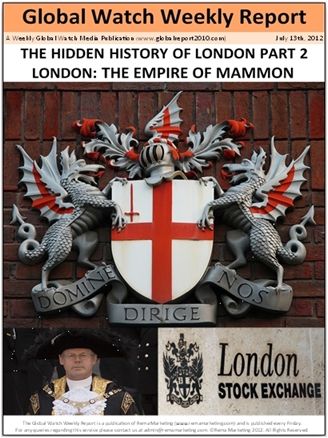

WHAT IS ‘THE CITY’?

The City of London Corporation is described in its promotional statements as “the world’s leading financial centre,” and as “the financial

and commercial heart of Britain, the ‘Square Mile’.” The

City of London is at the heart of the world’s financial markets. It is a unique concentration of international expertise and capital, with a supportive legal and regulatory system, an advanced

communications and information technology infrastructure and an

unrivalled concentration of professional services

Since the demise of the British Empire, worn out by two world wars that benefited it not a jot, Wall Street has popularly become identified as the international financial capital. Again, this is due to the error in thinking that British imperial interests were synonymous with international plutocracy,

and because Britain is no longer a world power, ‘London’ is subordinated to New York. However, The City of London Corporation is neither synonymous with Britain nor British interests, other than when these happen to coincide with the interests of international finance. That is why, even

though the British Empire has been defunct for over half a century, The City remains, in the words of its promoters, “at the heart of the world’s financial markets.”

Hence while Britain and the Commonwealth has a symbolic Head-of-State in the Monarch, the analogous Head-of-State for The City has precedence over the British Sovereign. The Lord Mayor

of the City of London Corporation is “not the Mayor of (Greater) London (presently Boris Johnson) nor is he a ‘mayor’ in the limited sense of the word. He assumes the position as ‘Head-ofState’, not merely a borough or a county. This Lord is elected for one year, and acts as a global ambassador for the international financial institutions situated in The City, and is “treated overseas as cabinet level Minister.”

He lives in the palatial 250-year-old ‘Mansion House’. On state visits the British Monarch waits at the Gate of The City to seek permission to enter and is presented with the sword of The City by the

Lord Mayor This tradition has been preserved for more than 400 years, and the ceremony now is carried out

on major state occasions where the Queen halts at Temple Bar to request permission to enter the City of London and is offered the Lord Mayor’s Sword of State as a sign of loyalty.

The present Lord Mayor is David Wootton

No matter how one rationalises the ceremony as an ostensible mark of ‘loyalty’ by The City towards the British Monarch, it is nonetheless the Monarch who is placed in a subordinated position in seeking permission for entry and waiting for a symbolic affirmation of loyalty from The City on each occasion.

INTERNATIONAL FINANCE

It should be kept in mind that ‘international finance’ is exactly that: international; not Dutch,

German, British, or American. Jewish bankers might be loyal to Judaism or to Israel, and the French Huguenots who went to London had a religious identity. But international finance is not bound to the states of its residence.

The ‘modern’ financial system did not originate in Britain, or even in the Occident. Ezra Pound, the famous poet who was also an avid opponent of usury banking and an advocate of Social Credit

banking reform, traced the premises of the ‘modern’ usurious financial system back to “the loans of seed corn in Babylon in the third millennium BC.”

As indicated above, international finance can shift focus over the world as the requirements of commerce dictate. As for the shift of the Money Power to England, this can be traced to the English

Civil War, and even to the Reformation, where a Cromwell was significant in both.

Thomas Cromwell, Secretary of State, who “represented the mercantile community,” as distinct from the traditional landed interests, urged Henry VIII to suppress the religious Orders in 1533.

Brooks Adams states of this in his historical masterpiece, The Law of Civilisation and Decay, that:

In 1533 Henry’s position was desperate. He confronted not only the pope and the emperor, but all that remained of the old feudal society, and all that survived of the decaying imaginative

age.

Nothing could resist this combination save the rising power of centralised capital, and Henry therefore had to become the mouthpiece of the men who gave expression to this force. He needed money,

and money in abundance, and Cromwell rose to a practical dictatorship because he was fittest to provide it. Adams details how the era of Henry VIII and the Reformation was the beginning of the speculative, capitalistic system. Additionally, “The sixteenthcentury landlords were a type quite distinct from the ancient feudal gentry. As a class they were gifted with the economic, and not with the martial instinct, and they throve on competition.”

The expansion of commerce in the wake of the Age of Exploration, and the formation of the British East India Company in 1600, five years after the East India Company in Holland, were symptoms of this historical trend that had already been set in motion by the Reformation.

The merchant interests felt constrained by the Monarchy and another Cromwell,

Oliver, came forward, like his greatgreat-grand-uncle Thomas, to radically change England in the interests of money. The British Empire was expanding towards Asia and buccaneering was establishing fortunes. However, As the city grew rich it chafed at the slow movement of the aristocracy, who, timid and peaceful, cramped it by closing the channels through which it reached the property of foreigners; and, just when the yeomanry were exasperated by rising rents, London began to glow with that energy which, when given vent, was destined to subdue so large a portion of the world. Perhaps it is not going too far to say that, even from the organisation of the East India Company, the mercantile interest controlled England. Not that it could then rule alone, it lacked the power to do so for nearly a hundred years to come; but, after 1600, its weight turned the scale.

Macaulay has very aptly observed that but for the hostility of The City, Charles the First would never have been vanquished, and that,

without the help of The City, Charles the Second could scarcely have been restored.

From the middle of the 16th century capital accumulated, and “the men adapted to be its instruments grew to be the governing class.”

Adams states of the era, “In 1688, when the momentum of England suddenly increased, the change was equivalent to the conquest of the island by a new race.”

London became the centre of this global expansionist acquisition, a new Rome, where the wealth of the world was deposited:

These hoards, the savings of millions of human beings for centuries, the English seized and took to London, as the Romans had taken the spoil

of Greece and Pontus to Italy. What the value of the treasure was, no man can estimate, but it must have been many millions of pounds – a vast sum in proportion to the stock of the precious metals then owned by Europeans.

What Adams calls a regime of merchants ruled England from 1688 to 1815. The wealth they accumulated, states Adams, became the primary source of power, and it was in the hands of a new

breed of merchant: the bankers.

“With the advent of the bankers, a profound change came over civilisation, for contraction began.”

The value of money as distinct from the mercantile concern at the value of wares was the concern of the bankers.

At the close of the 18th century “the great hoards of London” passed into the hands of the bankers, the “most conspicuous example” being the Rothschilds. It is here that we see a dichotomy arising between the old merchant, including the mercantile adventurers, such as Robert Clive of India to Cecil Rhodes, and on the other hand, the

merchant bankers epitomised by the Rothschilds. It is here where the two are often mistaken as forming a common power elite.

Dr. Carroll Quigley described the character of international finance and the move of its centre to The City:

“Financially, England had discovered the secret of credit. Economically, England had embarked on the Industrial Revolution.”

Here we discern immediately a dichotomy operating within British power-politics: that of usury-based finance, which is cosmopolitan and parasitic; and that of the ingenuity of the Englishman and Scott as inventor and entrepreneur, as creator. It was this creativity and inventiveness,

coupled with the bravery of the British military and the dedication of the British administrator, that was pressed into the service of parasitic finance, behind the cover of the British flag and Crown. These two factors at work: one cosmopolitan and one British, are often confused as being one and the same. Quigley continues:

Credit had been known to the Italians and the Nether- landers long before it became one of the instruments of English world supremacy.

Nevertheless, the founding of the Bank of England by William Paterson and his friends in 1694 is one of the great dates in world history.

Quigley explained, far more succinctly than economists, that the basis of the debt finance system is “fractional reserves.” This method had its origin in the realisation by goldsmiths that they did not need to hold the equivalent of gold reserves in their vaults to the amount of paper certificates issued representing the value of gold. As there was

un- likely to be a run on the vault by its depositors all demand- ing at once the return of their gold deposits, the goldsmith could issue paper certificates far in excess of the value of the amount

of gold in his vaults.

Fractional reserves remains the method of international finance, albeit no longer with the need for gold reserves.

In particular, it should be kept in mind that the

basis

of the system is usury, where interest is charged for

the loan of this bogus credit. Not only must the

principal be paid back in real wealth – productive

labour or creativity – but added interest.

Quigley remarks that “in effect, this creation of

paper claims greater than the reserves available

means that bankers were creating money out

of

nothing.” According to Quigley, William Paterson,

having obtained the Royal charter for the Bank of

England in 1694 remarked, “The Bank hath benefit

of interest on all moneys which it creates out of

nothing.” The centre of gravity for the merchant bankers had

long been Amsterdam. The “Republic of the United

Provinces,” which included Holland, had from the

start accorded Jews, as the catalysts of incipient

international free trade, equal protection.

The establishment of the Bank of England was a

Protestant affair with anti-Catholic underpinnings.

From France came the Huguenots who, like the

Dutch Sephardim, had established international

connections through family networks across Europe

and had also formed a community in The City, by

the mid 18th century.

The English Revolution of 1642-1648, which

established the republican Commonwealth under

Oliver Cromwell in 1649, enduring under his son

Richard until 1659, had opened the way for a shift of

international banking from Amsterdam to

London.

The impetus for British imperial expansion had

started under Cromwell. The merchant coterie of Amsterdam, which had

backed Cromwell, was permitted entry into England.

Menasseh ben Israel had appealed to Cromwell on

the grounds of mercantile profitability to any nation

that gave the Jewish merchant bankers freedom, as

Amsterdam had done. Menasseh assured Cromwell

that profit was the best reason why the merchant

bankers should be permitted into England:

Menasseh proceeded with explanations as to why

this is so, due to the lack of opportunity from the

time of the Exile, to possess a state of their own and

to till the land, leading Jews to “give themselves

wholly unto marchandising.”

Their dispersion throughout the world enabled them

to form networks across borders, to engage in

commerce, with a common language that

transcended the linguistic barriers of others.

While the supremacy of Money in England was set

in motion by Henry VIII’s Reformation, and the

English Revolution a century later heralded

the

triumph of the merchant, it was not until the

usurpation of the Throne by William III of Orange in

1688, with the deposing of James II, that the Bank

of England was established. From then on a

National Debt was owed to the usurers.

From the time of King Henry I talley sticks had

served as the King’s currency. These talley sticks

were carved sticks broken lengthwise. The

Chancellor of the Exchequer kept one half, and the

King spent the other half into circulation, like

President John F Kennedy did in 1963, when he

issued $4 billion ‘United States Notes’ directly into

circulation via the US Treasury, circumventing the

Federal Reserve Bank.

Eventually, the two halves would be matched to

prevent counterfeiting. The talley sticks could be

used as exchange for commerce and in payment of

taxes. They circulated in England for 726 years until

eliminated on the demand of the Bank of England in

1826.

Although William was the maternal grandson of

Charles I, he was born in Holland and destined

to

fulfil the legacy of Cromwell in placing England

under the bondage of the merchant bankers, then

centred in Holland. The anti-Catholic sentiment that

had started under Henry VIII was a catalyst in

assuring William support in driving James II from

the Throne. Under William the authority of the monarchy was reduced, and that of Parliament

enhanced.

The epochal act of William was to grant the Charter

to William Paterson to establish the Bank of

England. This acquiescence might be explained by

William having “heavily borrowed in Amsterdam to

fight his continental wars.”

The link between the bankers of Amsterdam and of

London was maintained even

into the 19th century,

and by the mid 18th century there was a

considerable colony formed in the City by the scions

of the Amsterdam banking families.

The idea for the Bank of England came from the

example of the Wisselbank, founded in 1609 which,

according to the Bank of England’s account, was

the lender to the City of Amsterdam, the Province

of

Holland and the Dutch East India Company,

exercising a monopoly over state borrowing and

coinage. The move to establish such a bank in

England gained momentum “after the Glorious

Revolution of 1688 when William of Orange and

Queen Mary jointly ascended the throne of

England.” The

political economist Sir William Petty wrote that

the power of England would be magnified if there

were a bank to lend the Throne credit. He did not

explain why it could not be a state bank issuing its

own credit, and had to be a private bank accruing

interest on credit that it makes out of nothing, as its

founder, William Paterson, ex- plained. According to

Petty such a

bank would “furnish Stock enough to

drive the Trade of the whole Commercial World.”

The Bank of England explains that after the

rejection by Parliament of several proposals the

bank and a “Fund for Perpetual Interest” were

accepted, having gained support from The City on

recommendation by Michael Godfrey, “a leading

merchant.”

In 1734 the Bank of England moved into a ‘vast’

purpose built building, nicknamed ‘The Old Lady of

Thread needle Street’, in The City. It was from the

founding of the Bank of England that “the funded

National Debt was born.”

The present-day description of credit by the Bank of

England is quite illuminating. The Bank’s historical

account states that at the time credit was called

“imaginary money.” Until then ‘the man in the street’

had simply thought of money as coins, but this

‘shibboleth’ was now overturned. Money could take

other forms “that had no intrinsic value.” “The 18th

century was a period dominated by governmental

demand on the Bank for finance: the National Debt

grew from £12 million in 1700 to £850 million by

1815, the year of Napoleon’s defeat at Waterloo.”

In 1946 the Bank was ‘nationalised’, but as in the

nationalisation of other such banks, such as New

Zealand’s Reserve Bank in 1936, this means little,

as the real authority comes from the creation of

credit by the international merchant bankers.

However, as the Bank’s account states, in 1997 the

Government formally handed its financial authorities

over to the Bank and it “thus rejoined the ranks of

the world’s ‘independent’ central banks.”

The purpose of these ‘central banks’, which the

general public believes are controlled by

governments, was to bring into their financial

network the provincial bank- ing centres… to form

all of these into a single financial system on an international scale which manipulated the quantity

and flow of money so that they were able to

influence, if not control, governments on one side

and industries on the other. The men who did this

aspired to establish dynasties of international

bankers. The centre of the system was in London,

with major offshoots in New York and Paris, and it

has left, as its greatest achievement, an integrated

banking system.

ROTHSCHILDS:

LORDS OF INTERNATIONAL FINANCE

From the establishment of the Rothschild banking

dynasty in England by Nathan M Rothschild, The

City becomes synonymous with that dynasty.

Further still, these suddenly ‘British’ Rothschilds

become ‘British’ imperialists in the manner a

chameleon changes his colour according to survival

needs. It is the insinuation of the Rothschilds into

the British power-structure that has generated much

discussion of a ‘British’ imperial conspiracy centred

around Cecil Rhodes and Alfred Milner, and the socalled ‘Round Table Group’ that they founded to

extend British influence throughout the world. It is

further frequently claimed this emerged as an ‘Anglo

-American’ power axis

Many cite Harvard historian Dr. Carroll Quigley, who

had access to what were presumably the papers of

the Council on Foreign Relations had some

pertinent things to say about both the Rothschilds

and the “international system of control” that was

developing.

Quigley stated that one of the primary reasons the

centre of international finance shifted to London was

because the British upper class, which was not as

rooted in noble birth as in money, “was quite willing

to recruit both money and ability from lower levels of

society and even from outside the country,

welcoming American heiresses and centralEuropean Jews to its ranks.” This allowed the power structure to take on a

cosmopolitan flavour. (We might note this

vulgarisation of the English ruling-class seems to

have begun during the time of Henry VIII).

Quigley described the

development of the financial

network by the international bankers into a world

control system, and the assumption of the Roths-

child dynasty to

primacy:

In time they brought into their financial network the

provisional banking centres, organised as

commercial banks and savings banks, as well as

insurance companies. The greatest of these

dynasties, of course, were the descendants of

Meyer Amschel Rothschild whose male

descendants, for at least two generations, generally

married first cousins or even nieces.

Rothschilds five sons, established at branches in

Vienna, London, Naples, and Paris, as well as

Frankfort, cooperated together in

ways which other

international banking dynasties copied but rarely

excelled.

Quigley pointed out these bankers were

“cosmopolitan and international rather than

nationalistic,” and this, by the very nature of their

business, is what they remain.

Brooks Adams states that towards the close of the

18th century the boards of The City passed from the

merchants to merchant bankers, “the most

conspicuous example [being] the family of

Rothschild.” Mayer Amschel had established his fortune by

handling the financial affairs of William IX of HesseKassel, who had been paid well by the British

Government for supplying troops against the

American revolt. At

the time Amsterdam had been

the capital of international banking, but the

Napoleonic invasion of Holland had led to the

closing of the Amsterdam Bourse, “the leading

Continental exchange.” Mayer Amschel and several

others were situated to provide William IX with

funds.

Additionally, in 1800 Mayer Amschel had become

Imperial Crown Agent for the Emperor of Austria.

He was what Derek Wilson described as “one of the

first of a new breed of businessmen – the truly

international merchant banker.” Wilson states that

for centuries the Jews had played a prominent part

in “long distance commerce” due to their communal

loyalty with which they were able to create a

“commercial sub-culture.” However, they were

reliant on the patronage of rulers. Now, the

revolutionary tumult in Europe had swept away

traditional rulers and placed money on a footing of

power.

In 1798 Nathan Rothschild set up shop in England

and in 1806 he became a “naturalised Englishman.”

The Rothschilds were backing the

coalition against

Napoleon, who was upsetting the Continental

system of finance. In 1808 Nathan took over the

financial affairs of the Landgrave William IX in

England. That year he moved his business to 12

Great Helen’s Street, The City, under the name of N

M Rothschild and Brothers. With agents throughout Europe, the Rothschilds

were valuable allies in organising smugglers and

couriers in the war against Napoleon. By now, on

the initiative of Nathan Rothschild, “the nerve centre

of Rothschild operations had shifted From Frankfurt

to London.”

Wilson reiterates that through Nathan’s family and

his “large network of agents and couriers he was

better informed about European affairs than any

man in London – including members of the

government.”

Wilson is altogether too charitable in ascribing

‘patriotic’– British – motives to Nathan, in contrast to

what he frankly says about the lack of national

‘patriotism’ among the other Rothschild brothers

toward anything other than

“loyalty and

responsibility to the Chosen People.”

Rather, Nathan and the rest of the dynasty were

assisting in the fight against Napoleon because the

upstart was undermining the financial system.

Quigley explains that the credit creation mechanism

developed by the international bankers, as

previously described, was to become one of the

chief weapons in the victory over Napoleon in 1815.

“The emperor, as the last great mercantilist, could

not see money in any but concrete terms, and was

convinced that his efforts to fight wars on the basis

of ‘sound money’, by avoiding the creation of credit,

would ultimately win him a victory by bankrupting

England.”

Hence, the war against Napoleon was in part a war

between two systems of economics involving the

reorganisation of Europe.

THE BRITISH EMPIRE& CECIL RHODES

The theory of the ‘Anglo-American’ network written

about by Quigley has become a hallmark of

understanding the

financial powers today. The basis

of these theories centres on Lord Rothschild being

the banker to Cecil Rhodes. The theory states that

Lord Natty Rothschild was part of Rhodes’ secret

society, the Round Table Groups, that aimed to

spread the benevolence of British imperialism over

the world. These imperial ideals were said to be motivated by

the teachings of the Oxford art historian John

Ruskin who exhorted his students to take British

culture to the ends of the Earth. While Lord

Rothschild saw the Empire as the means by which

commerce could be spread and maintained by force

of arms, the support was pragmatic, and owes

nothing to a commitment to any British ideals as

envisaged by Rhodes et al. Derek Wilson writes of

this in relation to Lord Rothschild’s op- position to

Gladstone’s ‘flabby’ foreign policy: “But Lord

Rothschild was not an unbridled expansionist. This

is clearly shown by his relationship with a man who

was an unbridled expansionist – Cecil Rhodes.”

When diamonds were discovered in South Africa,

the Rothschilds bought into the Anglo-African

Diamond Mining Company Ltd., which was

amalgamated with DeBeers. In 1887 Rhodes

returned from South Africa to Britain to ask Lord

Rothschild for financial backing. Lord Rothschild

saw this as the means of establishing commercial

stability in South Africa against their main rival, the

Barnato Diamond

Mining Company, which also

ended up merging with DeBeers.

For Rhodes, making money was a means of

spreading British imperial ideals. Not so for

Rothschild, although Rhodes persuaded himself

Natty was of like mind.

“He was actually wrong. Lord Rothschild was not an

unreserved imperialist, as Rhodes gradually

discovered.” In 1888 Rhodes made a will

nominating Natty to administer most of his estate for

funding The Round Table Groups. Wilson writes:

In response to Rhodes’ suggestion that company

funds be used to finance territorial expansion, his

banker advised: “if… you require money to finance

territorial expansion, you will have to obtain it from

other sources than the cash reserves of the

DeBeers Company.” And Rhodes cannot have been

very pleased to learn, in 1892, that Rothschilds had

floated a loan for the Boer government of the

Transvaal.

The Rothschilds were interested in commercial

stability, not British imperial expansion. By the time

of the abortive Jameson Raid organised by

Rhodes

against the Boer Transvaal Republic in 1895, he

had long ceased to have close and cordial relations

with Natty. Probably he never grasped the fact that,

though the Rothschilds disliked Gladstone’s policy

of colonial retrenchment, they were not advocates

of unbridled imperialism for its own sake.

Hence, when a few decades later

imperialism

became a hindrance to unbridled international free

trade, the international bankers used the newly

emergent power of the USA to scuttle the old

European Empires over the course of half a century,

and the oligarchs moved into the power-vacuum of

the new decolonised states.

Belief in an ‘Anglo-American network’ for world

control is centred around a supposed alliance

between the Royal Institute of International Affairs

(RIIA) and the US globalist think tank, the Council

on Foreign Relations (CFR), founded in the

aftermath of World War I by the US power elite. Soon after World War II the Rothschilds increased

their focus on Wall Street, and their hitherto

relatively small Amsterdam Incorporated was

reformed as an investment bank named New Court

Securities, its share capital being taken up by the

Rothschild banks in Paris and London.

Where hitherto the Rothschilds had mainly been

concerned with negotiating loans with states, they

were now involved in the rapid post-war expansion

of Western commerce and

industry, freed up by the

destruction of the old empires, and the inauguration

of a new era of international financial agreements,

formalised by the Bretton Woods Agreement.

This is what the biographer Wilson calls the

Rothschilds’ “new, deliberate internationalism”; no

longer constrained by nation-states and imperial

ideals. However, The City re- mains a focus.

The

Rothschilds led the way in forging links between

Tokyo and London. Edmund co-led a delegation

from The City to Tokyo in 1962 and received The

Order of the Sacred Treasure from Emperor

Hirohito. Regardless of these new avenues opened up for

post-war globalisation and free trade, certain

plutocratic traditions remain features of The City:

the ‘Gold Fixing Room’ at the Rothschild offices,

New Court, continue to be the place where the

leading London bullion dealers daily sit around a

table “to agree on the price of gold.” N M Rothschild

“continues to be the most important bullion dealer”

in Britain.

Of the “four hundred and

eighty banks in the city,”

Rothschild remains supreme.

LONDON: CAPITAL OF THE WORLD

However, other avenues for profit besides the

traditional dealings in gold bullion are emerging.

The one for our era is credits for greenhouse

emissions, and with this profit also comes new

schemes for world control.

In 2008 Simon Linnett, Executive Vice Chairman of

N M Rothschild, wrote a policy document on the

issue. Linnett defines “greenhouse emissions” as

the new form of “social market.” He states that while

it must be free trade that operates in defining the

value of the carbon emission exchange, what is

required is an “international institution.” He writes

that “such a market has to be established on a

world basis coordinated by an international

institution with a constitution to match.” Linnett

frankly states that this involves a “new world order”:

That, perhaps, it might be regarded as having wider

benefits than merely ‘saving the planet’ – perhaps it

might be the basis of a new world order

Of various methods suggested to limit carbon

emissions, carbon trading is held by Linnet to be the

most effective. Implicit in the various measures,

including funding new technology and changing the

consumption habits of individuals is, “that nations

have to be prepared to subordinate, to a certain

extent, some of their sovereignty to this world

initiative.”

“When countries are already foregoing the right of

direct control over monetary policy through the

creation of independent central banks, this could be

a relatively small price to pay for such inclusion.” The system being proposed by Linnett, in the cause

of “saving the planet,” is the consolidation of the

international banking system under a

central

authority. Linnett states that the European nations

have already ceded their sovereignty to the

European Union; the next step being, “to yield

sovereignty to a bigger world body on carbon

trading.”

“If such a route map could be found, then perhaps

we might be at the beginning of a new world

constitution and a new world order.”

The world authority that Linnett proposes he calls

the World Environment Authority (WEA). This would

be based in what he calls a “world city.” Linnett

suggests that this “world city” should be London,

The City, due to it being “a world financial centre

(possibly ‘the’ world financial centre).” Whatever might be said about Wall Street, or the

shift of global political power to Washington and

New York, clearly The City still holds sway in the

thinking of some of the primary oligarchs of

international finance.

Mr Wijat's friend Magic Rabbit

Mr Wijat's friend Magic Rabbit

Beaches

Beaches Gastronomy

Gastronomy Culture

Culture Countryside

Countryside

–

–

orts in the

Mail show that Boris has a raft of new plans for helping to keep the

London economy ticking over in these almost-recession times, one of which

orts in the

Mail show that Boris has a raft of new plans for helping to keep the

London economy ticking over in these almost-recession times, one of which  No, that’s not what determines the legislation that comes out of the

Mayoral office — it’s how good ol’ BoJo described his barnet upon winning an

award for

No, that’s not what determines the legislation that comes out of the

Mayoral office — it’s how good ol’ BoJo described his barnet upon winning an

award for

A reputable news source has recently reported that Boris has

officially claimed we’re ready for the 2012 Olympics…

A reputable news source has recently reported that Boris has

officially claimed we’re ready for the 2012 Olympics…  As it’s getting

to that festive time of year again (not that you’d know it, given that most

places have had Christmas decorations up since before Hallowe’en), many people

have started to consider a seasonal break to our nation’s capital. Boris, of

course, is well in favour of that… so much so that he’s

As it’s getting

to that festive time of year again (not that you’d know it, given that most

places have had Christmas decorations up since before Hallowe’en), many people

have started to consider a seasonal break to our nation’s capital. Boris, of

course, is well in favour of that… so much so that he’s